LIBOR transition - Transfer Pricing considerations (updated April 2022)

Throughout the world, a transition is currently taking place from interbank offered rates (IBORs) to alternative benchmarks. Per January 1, 2022, LIBOR (London Interbank Offered Rate) - a reference point used globally for variable interest rates charged on financial products - is no longer published for most currencies (LIBOR rates were published for all major currencies, such as USD, EUR, GBP, JPY and CHF).

- The EUR Libor and the CHF Libor rates are no longer published as of January 1, 2022

- GBP Libor and JPY Libor rates (only for 1- 3- and 6-month tenors) are artificially issued by their administrators during 2022 to assure legacy contracts remain effective for a longer period to assure an easier transition.

- USD Libor will continue to be published until June 30, 2023. The USD regulators have implemented legislation to assure no new USD Libor contracts may be issued as of January 1, 2022.

As a result, over time, all IBORs will have to be replaced with an alternative system for determining the base component in variable interest rates. The alternative for the IBORs is expected to be several other government-sanctioned benchmarks for a Risk‑Free Rate or RFR. These benchmarks will be used for a wide variety of contractual arrangements and financial instruments containing variable interest rates.

The IBOR transition was initiated as a policy response to two developments. First, a number of traditional interest-rate benchmarks, notably LIBOR, were affected by market manipulations that severely undermined their integrity. Second, the underlying market for unsecured interbank funding experienced a marked decrease in transactions — and continues to do so — eroding the degree to which IBORs represent the funding costs of financial institutions.

The IBOR transition will not only have an impact on financial markets, as such, but may also have an impact on the intercompany pricing of loans, which often also make use of IBOR rates as a variable interest component.

Transfer Pricing considerations

As businesses are in the process of adapting their external financial arrangements to a world without LIBOR, they should also consider the potential impact this fundamental change could have on the arm’s length nature of their intercompany financial transactions.

Replacing LIBOR will require companies to evaluate any LIBOR-based variable interest rate pricing on intercompany transactions. Situations may arise where intercompany financial transactions are based on LIBOR rates that have already been phased out. Companies will therefore need to consider alternative base rates to replace LIBOR as soon as possible. These alternative benchmarks may require the application of an ‘arm’s length spread’ on intercompany financial transactions, so that neither party to the transaction is disadvantaged. There is not yet any specific Dutch LIBOR transition tax guidance on how to calculate this arm’s length spread, but any such analysis will need to follow the principles set forth under existing transfer pricing rules.

Following the announcement that LIBOR would be discontinued, alternative RFRs have been introduced for various currencies, such as:

- Secured overnight financing rate (SOFR) for USD

- Unsecured Sterling overnight index average (SONIA) for GBP

- Unsecured Tokyo overnight average rate (TONAR) for JPY

- Secured Swiss average rate overnight (SARON) for CHF

- Unsecured Euro short‐term rate (€STR) for the Euro (replacing EONIA) EURIBOR remains in effect

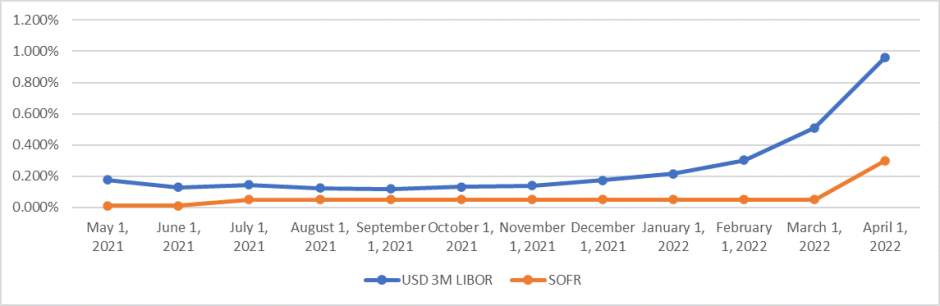

The alternative RFRs are mostly published as overnight rates. This is a significant change compared to the LIBOR rates that are published in various terms (e.g. one-month, three-months, etc.). In order to account for the different terms of the alternative RFRs, compared to the LIBOR, an analysis will need to be carried out to assess any transfer pricing impact. The necessity for a detailed transfer pricing analyses becomes clear when comparing LIBOR rates with the alternative reference rate. When we compare SOFR with a commonly used 3-month USD LIBOR rate we see differences in the applicable rates, which will only increase when comparing SOFR with more long-term USD LIBOR rates (such as 6- or 12-month rates).

Spread analysis (based on applicable rates per the first day of the respective months) SOFR versus USD 3-month LIBOR for May 1, 2021 – April 1, 2022. Rates derived from www.global-rates.com on April 15, 2022

The above analysis details the importance of performing a transfer pricing analysis, which should aim at replacing a LIBOR rate with a replacement rate, without a significant impact on the total applicable rate after conversion. Generally this will entail an adjustment to the spread applied over the SOFR rate. As an example: when historically a rate of USD 3-month Libor + 1% was applied, the spread of 1% is expected to be increased after transition, as the applicable SOFR rate is expected to be lower compared to the previously applied USD 3-month Libor rate. An applicable rate after conversion may in this case be as follows: SOFR rate + 1.2%.

To allow for an efficient transition, commercial tools are available in the market that can assist with the process.

Companies will also need to ensure that the changes are supported by contractual clauses in both new and existing agreements. To the extent LIBOR is referenced in existing agreements, appropriate fallback language should be included. However, companies should, where possible, avoid making changes that are so substantive that tax authorities could argue that a new loan has been issued, rather than an existing loan having been changed.

From a transfer pricing perspective, related parties should transact with one another in the same way as unrelated parties would under similar facts and circumstances. Therefore, it is useful to also look at relevant industry practices.

Various industry associations, such as ISDA (International Swaps and Derivatives Association) and the Loan Markets Association (LMA), have developed standard fallback texts for the IBOR transition. The EU Working Group has also prepared a general fallback text that can be used, but which may have to be customized to reflect the particular needs of a contract.

Recommended steps

Given the scope of the impact of the LIBOR phase-out, it is important for affected companies to manage this transition carefully and to account for any differences between the two rates (i.e. LIBOR and new RFRs).

The recommended first step is for companies to identify intercompany agreements containing LIBOR references and modify those agreements.

Once the impacted agreements are identified, companies should develop a plan to adjust the pricing of their affected arrangements so that these are ready once LIBOR is discontinued. With about three months remaining before LIBOR is discontinued, being proactive now will help to mitigate or prevent any future disputes.

If you would like further information about and/or assistance with the Libor transition, please let us know.

Feel free to contact Mark Bonekamp (+31 6 21 20 10 41), Lennaert Mosk (+31 6 20 13 81 55), or another member of the Dutch transfer pricing team.

Please note that we also have specialized lawyers at Meijburg Legal who can assist you with the broader legal impact of the Libor transition. For more information about how to deal with the Libor transition from a legal perspective, please click here