NL-Africa Tax Newsletter – February 2023

Dear business relation,

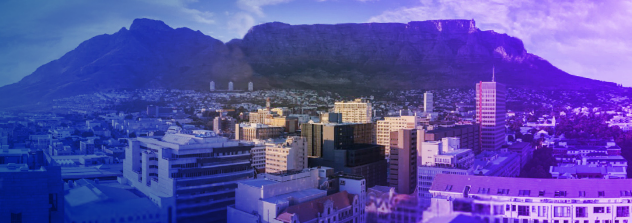

This month’s NL-Africa Tax Newsletter includes the latest on the tax proposals in the 2023-2024 budget of South Africa and Botswana, as well as a mining sector update for Nigeria. Next to that, we would like to invite you to join the 2023 KPMG Africa Tax Summit on 4-5 April in Cape Town, South Africa. The 2023 KPMG Africa Tax Summit will highlight what tax professionals can expect in the coming months and years, exploring top-of-mind issues affecting Africa’s tax landscape and how to navigate through disruption. Join this summit for two days of insights-led dialogue, impactful debates and networking opportunities. You can register here.

If you would like to know more about the matters addressed in this newsletter or have any feedback, you are welcome to contact Sebastiaan Paling (Head of the NL-Africa Tax Newsletter). Please visit our website for more information on the NL-Africa Tax Newsletter and the services we offer or to download our factsheet.

Best regards,

NL-Africa Tax Newsletter team

Meijburg & Co

------------------------------------------------------------------------------------------------------

Registration is now open for the 2023 KPMG Africa Tax Summit

Africa

- BEPS Pillar 2: the African Tax Administration Forum (ATAF) has released its Suggested Approach to Drafting Domestic Minimum Top-Up Tax Legislation

- Electronic invoicing (e-invoicing) and digital reporting global updates

- OECD toolkit to strengthen effective collection of VAT on e-commerce in Africa

- Taxation of the digitalized economy - update on global developments

- Transfer pricing documentation summaries by jurisdiction

Benin

Botswana

Ghana

- 2023 budget passed by Parliament includes VAT and e-levy amendments

- Inauguration of Independent Tax Appeals Board

- Mandatory online filing of individual income tax returns

Kenya

- CRS implementing regulations effective 1 January 2023

- Exemption from insurance premium levies

- Regulations to actualize taxation of gains from financial derivatives

Mauritius

Netherlands

Nigeria

- Federal Inland Revenue Service only authority for assessment and collection of taxes (court decision)

- Mining sector update

- Network facilities providers not subject to National Information Technology Development Agency (NITDA) levy (Tax Appeal Tribunal decision)

South Africa

- Extension of utilization period of carbon offsets for purposes of carbon tax in 2023 budget

- Guidance providing clarification for FATCA reporting TIN codes

- Multilateral Convention (MLI) - South Africa publishes synthesized texts of tax treaties

- Summary of the tax proposals included in the 2023/2024 budget