Policy statement on Hybrid Mismatches updated; no longer double taxation in cost-plus situations

On November 3, 2022 Deputy Minister of Finance Marnix van Rij published an update of the Policy statement on Hybrid Mismatches. In it he states that in cost-plus situations the deduction of costs can still take place and economic double taxation is avoided. The spirit and intent of the anti-abuse measures is thus respected. This approval is discussed in more detail below.

Introduction

Since January 1, 2020 the Corporate Income Tax Act 1969 has included anti-hybrid mismatch measures. This measures are from the ATAD2 Directive. In general, a hybrid mismatch involves the situation where differences between tax systems with regard to the qualification of entities, instruments or permanent establishments lead to:

- a deduction, but the corresponding income is not taxed anywhere (‘deduction without inclusion);

- the same fee, payment, expense or the same loss are deducted more than once (double deduction).

The Dutch anti-hybrid mismatch measures combat these outcomes by refusing the deduction or additionally taxing the income.

Double income exemption

For certain anti-hybrid mismatch measures, a deduction will not be refused or income will not be additionally taxed if and insofar there is dual inclusion income. The reason for this exception is that the hybrid nature of an entity (or permanent establishment) can, on the one hand, result in a fee or payment being deductible more than once or not being taxed, but on the other hand can also result in income being taxed twice. And since to that extent no tax benefit is ultimately realized from the hybrid nature of the arrangement, the anti-hybrid mismatch measures do not apply.

The cost-plus problem

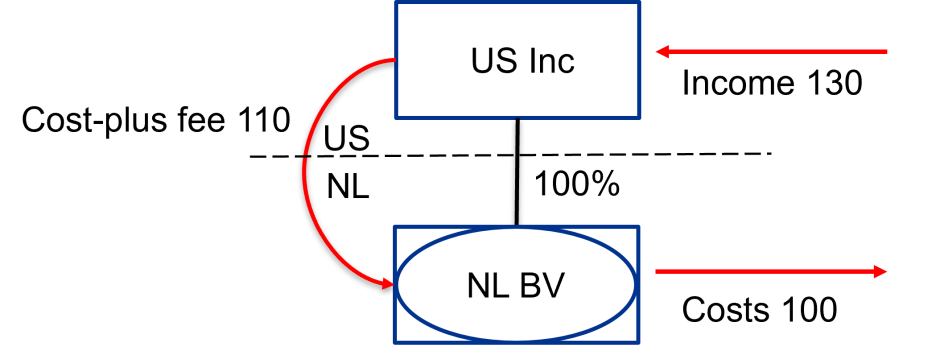

During the parliamentary debates a case was raised where a US parent company (hereinafter: US Inc.) held 100% of the shares in a Dutch private limited liability company (hereinafter: NL BV). NL BV was transparent for US tax purposes. It was non‑transparent for Dutch tax purposes and was therefore subject to Dutch tax. NL BV had 100 in costs and produced on behalf of US Inc. NL BV received an arm’s length mark-up of 10% of the costs and thus received a fee of 110 from US Inc.

The conclusion was that the 100 in costs incurred by NL BV were, in principle, deductible in the Netherlands. These costs were also deductible in the US, because NL BV was regarded as transparent for US tax purposes. Because the costs were deductible in both the Netherlands and the US, it was concluded that there was a double deduction. The deduction of 100 was therefore not allowed to be taken into account in determining the profit of NL BV, unless there was dual inclusion income.

As to whether there was dual inclusion income, the answer was No. Although the fee of 110 that NL BV received was subject to tax in the Netherlands, it was not taxed in the US. The Deputy Minister stated that, like the MPs who had raised questions about this, he shared their unease as regards the outcome, but given the text of the EU Directive, he did not see any room to conclude otherwise.

New approval in the Policy statement on Hybrid Mismatches

In the updated Policy statement on Hybrid Mismatches the Deputy Minister notes that the European Commission had recently again been approached about whether, in line with the spirit and intent of the directive, the deduction limitation may nevertheless be disregarded in certain cost-plus situations. The result of that discussion was such that there is sufficient scope to conclude that in specific circumstances there is dual inclusion income.

This means that the above cost-plus fee of 110 now does qualify as dual inclusion income because the:

- deduction limitation results in double taxation: only deducted once

(100 at US Inc) and income taxed twice (130 at US Inc and 110 at NL BV); - cost-plus fee is subject to a profit tax at NL BV and this fee is not, de jure or de facto, directly or indirectly deducted from the tax base of a profit tax (‘taxed without a corresponding deduction’).

This position applies to financial years commencing on or after January 1, 2020. Tax assessments that have become irrevocable can be reduced ex officio.

KPMG Meijburg & Co comments

It is commendable that the Deputy Minister has thought about this constructively and has persisted in approaching the European Commission in order to arrive at a good and workable solution with regard to the aforementioned problem. After all, anti-abuse measures to combat double deductions or a deduction of costs without the income being taxed must also not result in economic double taxation. It is important to note that the Deputy Minister has stated that he believes it is conceivable that the spirit and intent of the double income exemption may also apply in other situations than the cost‑plus case outlined above. Just how broadly or narrowly this statement should be understood is not clear from the text of the policy statement. Does the approval only apply to cost-plus arrangements or can other arrangements also use this (welcome) approval?

If you have decided not to deduct costs due to the passage in the parliamentary records, then we would like to point out that by invoking the Policy statement on Hybrid Mismatches you will still be able to deduct those costs. If your tax assessment has become irrevocable, you will have to request an ex officio reduction.

If you would like more information about the Policy statement on Hybrid Mismatches and/or the anti-hybrid mismatch measures in general, your designated Meijburg tax advisor would be pleased to help you.