The taxing effects of COVID-19 on private companies

Following a recent Global Tax & Legal webcast where some of my colleagues presented, I wanted to reflect on some of the key takeaways from that presentation in terms of how they might play out in the world of private companies.

Certainly, the world of business is being kept very busy. Not only are companies assessing the impact of the multitude of changing circumstances created by COVID-19, they are also having to sort through a host of new laws and regulations to determine how they might be affected.

In most countries, the tax authorities have responded quickly to the changing circumstances of people and business by introducing relief measures such as deferred tax filings to reduce the pressures on businesses, tax-rate reductions, and VAT exemptions. In a few cases, such as Australia and Italy, the government has temporarily suspended its tax audits.

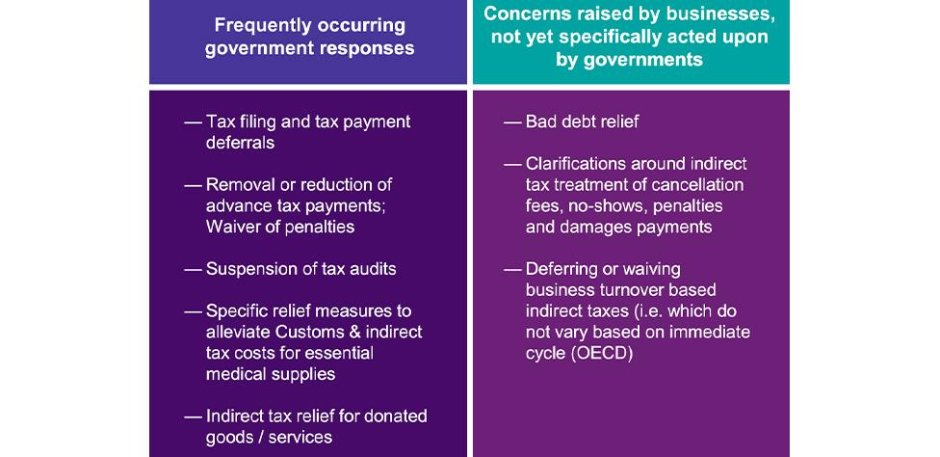

Indirect tax relief

Some government indirect tax responses have been limited to a few jurisdictions or selected industries, such as targeted reductions in indirect tax rates for hotels and airlines and accelerated refunds of indirect tax credits in countries such as Indonesia, Australia, and Poland.

More commonly, we are finding countries introducing initiatives, such as those listed in the charts shown below, in an effort to mitigate the impact of COVID-19 on the health of their country’s businesses, including entrepreneurs and other private companies.1

"Managing through a crisis: tax and legal implications" -- KPMG Global Tax, Legal and Mobility Virtual Meeting, March 24, 2020

In the Netherlands for example, companies can request payment extensions for customs duties and excise taxes, including those applicable on non-alcoholic beverages. The customs authorities are assessing these requests on a case-by-case basis, and granting payment extensions up to the 15th day of the month following the termination of COVID-19 measures. Companies may also request tailored solutions if they are unable to meet strict statutory deadlines, such as submitting supplementary customs declarations, administrative appeals or refunds and remission requests on a pro-forma basis.

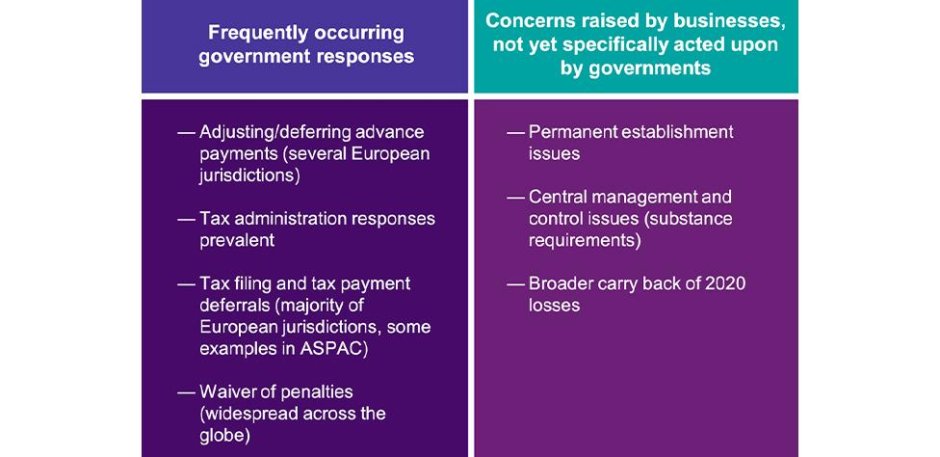

Direct tax response

Government direct-tax responses have been limited to date with very few examples of broad-based rate reductions. Some targeted direct tax relief has been provided to support specific industries and occupations, such as Austria and Croatia’s tax exemptions on the aid received by individuals and companies and for losses incurred by tour operators in Poland.

The direct tax initiatives that have been introduced thus far have been focused primarily on helping companies manage their immediate cash-flow challenges through tax filing and payment deferrals and adjustments to advance payments. For private companies, this can be especially important. They tend to take the long-term view and are inclined to be more self-reliant in addressing their business concerns. Under COVID-19 circumstances, however, they may have a more urgent need for outside assistance to support their cash-flow requirements.

"Managing through a crisis: tax and legal implications" -- KPMG Global Tax, Legal and Mobility Virtual Meeting, March 24, 2020

The Dutch government has lowered its interest rate to 0.01 percent per year on late tax payments. Many other countries have extended their tax filing dates without the accrual of penalty charges or interest throughout the extension period.

The search for new revenue begins

Now that steps have been taken to support businesses affected by the virus, it is likely that governments and their budgets will be under a great deal of pressure. As the situation settles, they will likely begin to look for ways to increase revenues from sectors where the impact of COVID-19 may be less. Some may even begin to take a closer look at certain sectors where businesses are growing post-virus, such as increasing direct taxation of digital companies in India.

Now, even more than ever, I believe we have an obligation to continue to follow responsible tax principles. Governments are taking extreme measures to support business and they need to continue to behave responsibly when taxpayers are faced with extreme difficulties beyond their control. Likewise, I believe that tax relief is a privilege that should be considered carefully to determine if it is necessary for your business.

The information presented in this was current at the time of writing. However, we recognize that new stimulus packages and economic relief measures are being introduced regularly – throughout the world – in an effort to support commercial enterprises and shore up the nations’ economies. This should bring welcome news to entrepreneurs and other private company owners.

For an overview of tax developments that are being reported globally by KPMG member firms in response to COVID-19, visit our Jurisdictional tax measures and government reliefs in response to COVID-19 webpage.

We at KPMG Private Enterprise understand the potential consequences of the current global health situation for private companies. Writing this from my home in the Netherlands, I encourage you to follow our regular series of blog posts to stay informed about how COVID-19 may affect your business strategy and operations, and to reach out to KPMG Private Enterprise advisers in your country or territory for their guidance. For an additional view on the possible tax implications, you may also want to check out our recent blog on how, “Quarantines might impact tax residency”.

Please visit the KPMG website for a summary of global tax-relief initiatives titled “ COVID-19 Global Tax Developments Summary” (PDF 1.8 MB).

Please visit the KPMG website for a business overview and action checklist titled “Understanding the Implications of COVID-19 for private companies” (PDF 382 KB) and a guide to robust business continuity planning titled “Leading successfully in turbulent times” (PDF 617 KB).